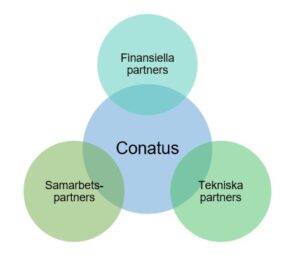

The transformation of Europe’s real estate requires expertise and execution in three industries; energy, finance and real estate. Collaboration is key. Conatus brings together Nordic players in the three industries and gives you unique access to technology and expertise that ESG-proofs your real estate investments. With Conatus as your ESG partner, you can make safe investments that strengthen property value, through the right green transition in a simpler, more efficient and smarter way.

Cooperation with Conatus gives you the right basis for investment decisions

Conatus offers investors and property owners a secure ESG* partner throughout the life of the fund or property. Our method means that we bring together the best digital actors in the ESG area. By building up key information about your buildings and making this available to our partners, it can quickly, easily and effectively contribute with their respective competences/deliveries. With this as a basis, Conatus can quickly and with high quality decision-making support in all phases of your property holding.

The collaboration with our partners means that Conatus can support with analysis, recommendations, implementation and financing to lift the energy performance of properties and ESG-proof them so that the value increases. After the analysis, all collected ESG-related information, analyzers and action plans are readily available. It lays the foundation for quick and cost-effective analyses for future decisions concerning properties, and shows how developments affect the sustainability profile.

*ESG = Environmental, Social & Governance.

Conatus System

Through Conatus’ active role during an acquisition or analysis process, a database is built with updated data, energy balance model and facts about all buildings and their operation. All this information is the basis for investment decisions, operation and maintenance optimization and further development of properties that are analyzed.

The Conatus System collects ESG-relevant property data and makes it available to you as a property owner or investor, with a simple and efficient digital interface. All collected information, completed analyzers and action plans are in the system and become an active structural capital to be used for future use.

The Conatus System can be used to identify consequences of renovations from an ESG perspective, to create unique development plans for each property (business plan) – which is the basis for ongoing management – and to always have access to the right property-related data, etc.

Your support if you are to acquire properties

The scalability of being able to quickly identify the right properties to acquire is not previously available on the market. The Conatus System quickly identifies and simulates a building’s hidden potential by benchmarking against over 20,000 buildings and doing more than 30,000 analyses/selected building so that a practically tested investment cost is produced. The automated and scalable working method creates fast and cost-effective and higher accuracy and decisions during the acquisition process.

Let us become your ESG partner

By using already collected information and created digital models, we can quickly make new analyzes at low cost, which results in lower total costs and higher quality in decision-making material compared to technical consulting investigations. This, in turn, means less invested resources (internal and external) and the right ESG-related efforts, which both saves money and reduces risk.

Please, contact us for further discussions about your company’s opportunities to develop together with us, in line with the EU’s taxonomy regulations.

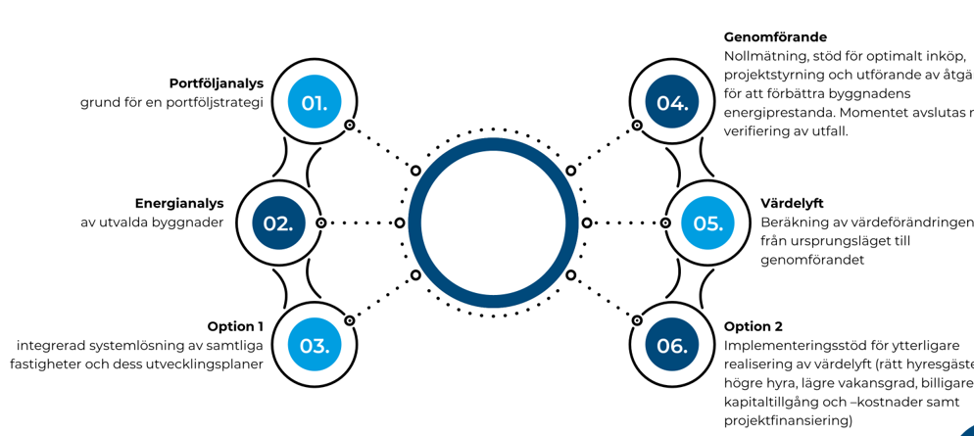

We take an overall lift and realize the value lift of the properties in 6 steps

(read more below the picture which is in Swedish)

- Portfolio analysis

Basis for a portfolio strategy - Energy analysis

of selected buildings - Option 1

Integrated system solution for all properties and development plans for them - Implementation

Zero metering, support for optimal purchasing, project management and implementation of measures to improve the building’s energy performance. The phase ends with verification of the outcome - Value enhancement

Calculation of the change in value from the original state to the implementation - Option 2

Implementation support for further realization of value enhancement (right tenants, higher rent, lower vacancy rate, cheaper capital access and costs and project financing

With modern and cost-effective working methods, the energy performance of properties can be lifted in a short time, with minimum payback time and with little disruption to operations.

Energy lift and value lift to secure your real estate investments

With energy lift, a basis is created for the increased value of properties. Based on this, further economically increased values can be created through Conatus’ value enhancement model.

We contribute to increased value of assets and reduced risk by cost-effectively offering:

Improved cash flow through higher income (lower vacancy rate, higher rent) and lower costs (capital costs, operating costs, insurance costs)Lower ESG risk – Future bans on fossil fuels, demands for sustainability in the financial sector and regulatory requirements for energy performance can become a risk for owners of buildings with low energy performance. This can be remedied effectively with relatively low stakes

Higher customer satisfaction by meeting customers’ demands for sustainability

Increased property value that can be realized upon sale

Our Vision

Conatus will contribute to the energy tansition of Europe’s buildings

- With a unique combination of partners and efficient working methods, we increase the value of properties through the right green conversion

- With modern and cost-effective working methods, the energy performance of properties can be lifted in a short time, with minimal payback time and little effort for the businesses

- With energy lift, a basis is created for the increased value of properties. With this as a basis, additional economic value can be created through Conatus’ value enhancement model